what is the capital gains tax in florida

The state of FL has no income tax at all -- ordinary or capital gains. Florida does not have state or local capital gains taxes.

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet. What is the capital gains tax rate for 2021 in Florida. Taxes capital gains as income and the rate reaches 5.

Federal long-term capital gain rates depend on your. What would capital gains tax be on 50 000. Florida does not have state or local capital gains taxes.

Florida Capital Gains Taxes. Long-term capital gains on the other hand are taxed at either 0 15 of 20. Florida does not assess a state income tax and as such does not assess a state capital gains tax.

The State of Florida does not have an income tax for. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level.

Individuals and families must pay the following capital gains taxes. Long-term capital gains tax is a tax applied to assets held for more than a year. The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations.

In this instance the taxpayer would pay 0. Understanding Capital Gains Tax On. That tax is paid to the local Florida.

The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the. Taxes capital gains as income and the. Any money earned from investments will be.

Taxes capital gains as income and the rate reaches 45. What is the capital gain tax for 2020. The tax rate you pay on your capital gains depends in part on how long you hold the.

The Combined Rate accounts for the Federal capital gains rate the. During this time the value of the property increased by 100000. Florida does not have state or local capital gains taxes.

Capital gains are treated differently. Heres an example of how much capital gains tax you might. There is no Florida capital gains tax on individuals at the state level and no state income tax.

Generally speaking capital gains taxes are around 15 percent for US. The long-term capital gains tax rates are 0 percent 15. Ncome up to 40400.

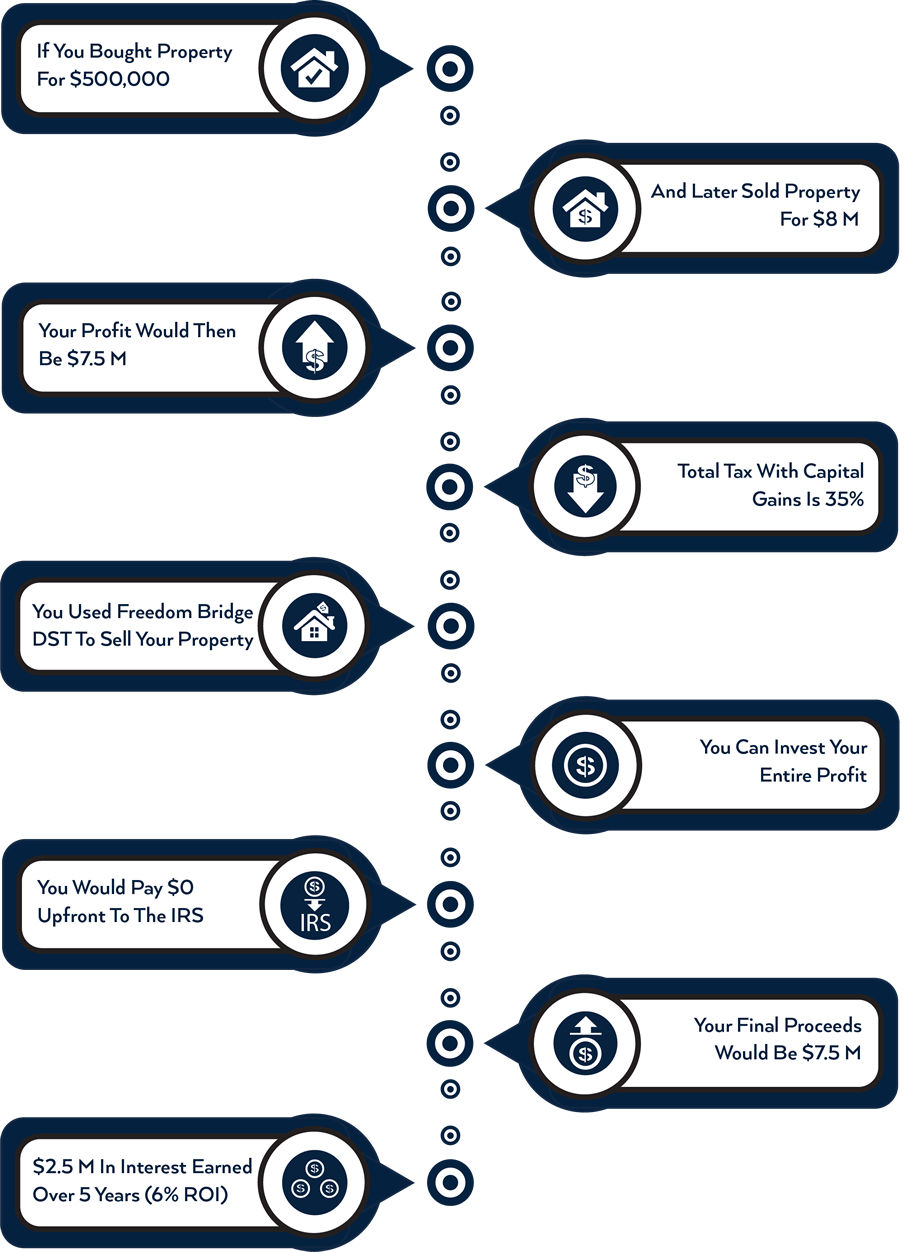

We always remind sellers about the Capital Gains tax and recommend they consult their accountant to figure out their capital gains liabilities long before the closing date because. The capital gains tax is a tax on money earned from investments rather than from wages or salary which are generally subject to income tax. Residents living in the state of Florida though there are those.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. There is no Florida capital gains tax on individuals at the state level and no state income tax.

For example you inherited a house worth 500000 and kept it for 5 years. Therefore youll have to pay capital gains from. All properties in Florida are assessed a taxable value and owners are responsible to pay annual property taxes based on that value.

What taxes do you pay when you sell a house in Florida. Its called the 2 out of 5 year rule. What You Need To Know 2022.

The schedule goes as follows. If the capital gain is 50000 this amount may push the taxpayer into the 25 percent marginal tax bracket. The rate you receive will depending on your total gains earned.

Special Real Estate Exemptions for Capital Gains.

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

2022 Capital Gains Tax Rates Federal And State The Motley Fool

State Taxes On Capital Gains Center On Budget And Policy Priorities

Guide To The Florida Capital Gains Tax Smartasset

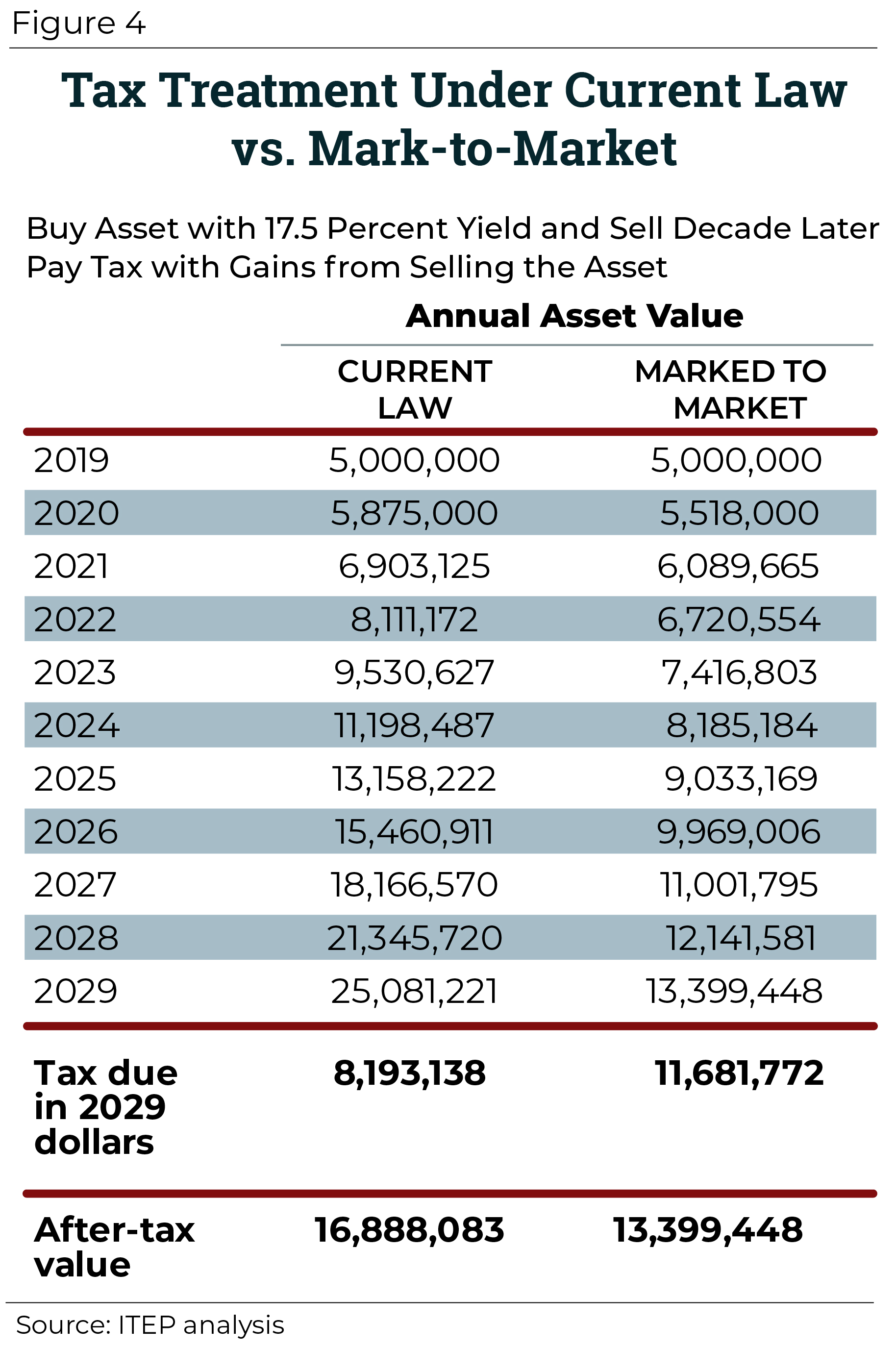

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

2020 2021 Capital Gains Tax Rates And How To Calculate Your Bill

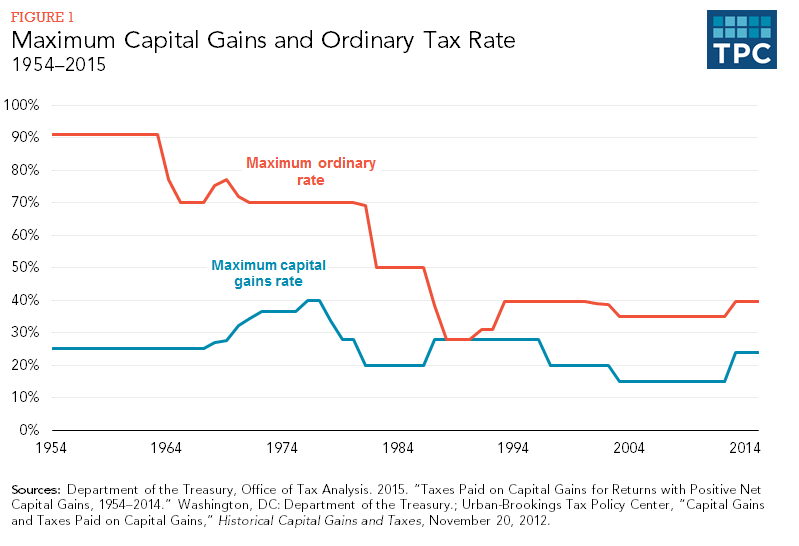

Capital Gains Full Report Tax Policy Center

What You Need To Know About Capital Gains Tax

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term Capital Gains Tax Rates For 2022 Smartasset

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

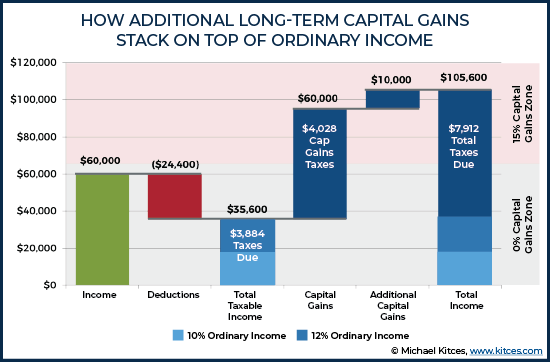

The Tax Impact Of The Long Term Capital Gains Bump Zone

Indexing Capital Gains Basis For Inflation Florida Chamber Of Commerce

What Is The 2 Out Of 5 Year Rule

Florida Real Estate Taxes What You Need To Know

Capital Gains Tax On Stocks What You Need To Know The Motley Fool